Menu

Get ready to kick off the new school year with McKinney ISD's back-to-school newsletter! Packed with essential updates, helpful tips, and exciting events, it’s your ultimate guide to a successful start. View newsletter

The track at Scott Johnson Middle School will be closed for the summer for maintenance. It will reopen at the beginning of the school year.

Finance

ESSER III

- ESSER III Uses of Funds Plan

- ESSER III Return to In-Person Instruction and Continuity of Services Plan

- ESSER III Expenditure Report Reimbursement

Financial Transparency

McKinney ISD is at the forefront of financial transparency among school districts. We have been awarded numerous awards for Financial Transparency throughout the years. Most recently, MISD was awarded a Transparency Star in both Traditional Finances and Debt Obligations from the state comptroller. MISD takes a great deal of pride in it’s Financial Transparency and will continue to remain diligent in it’s communication of district finances.

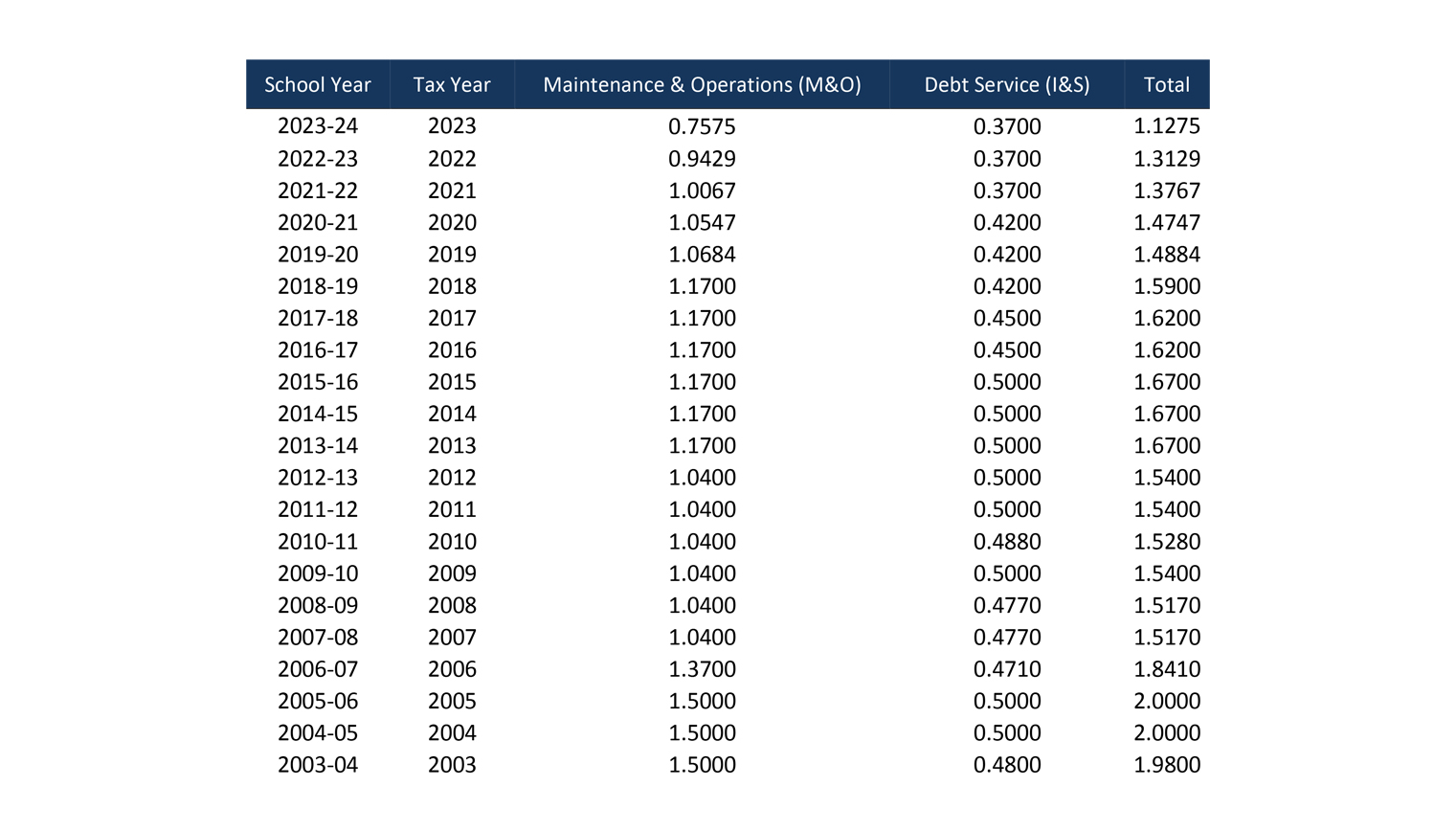

Current Tax Rate

2023 adopted tax rate is $1.1275 per $100 valuation. The combined tax rate is a combination of an M&O tax rate of $0.7575 and an I&S tax rate of $0.3700.

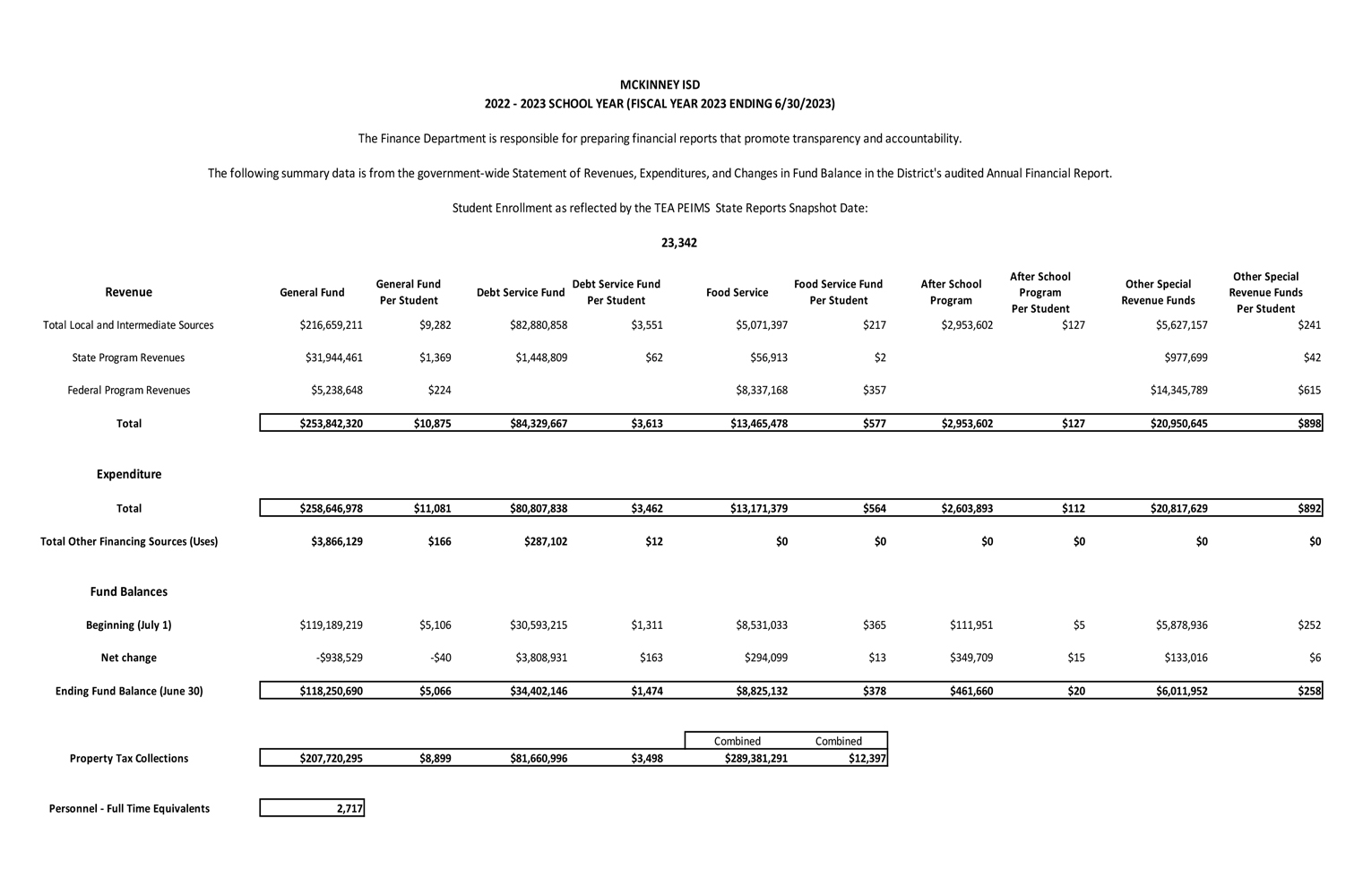

2022-23 School Year [Fiscal Year 2023 Ending 6/30/23]

The above summary data is from the government-wide Statement of Revenues, Expenditures, and Changes in Fund Balance in the District’s audited Annual Financial Report.

2022-23 School Year (PDF)

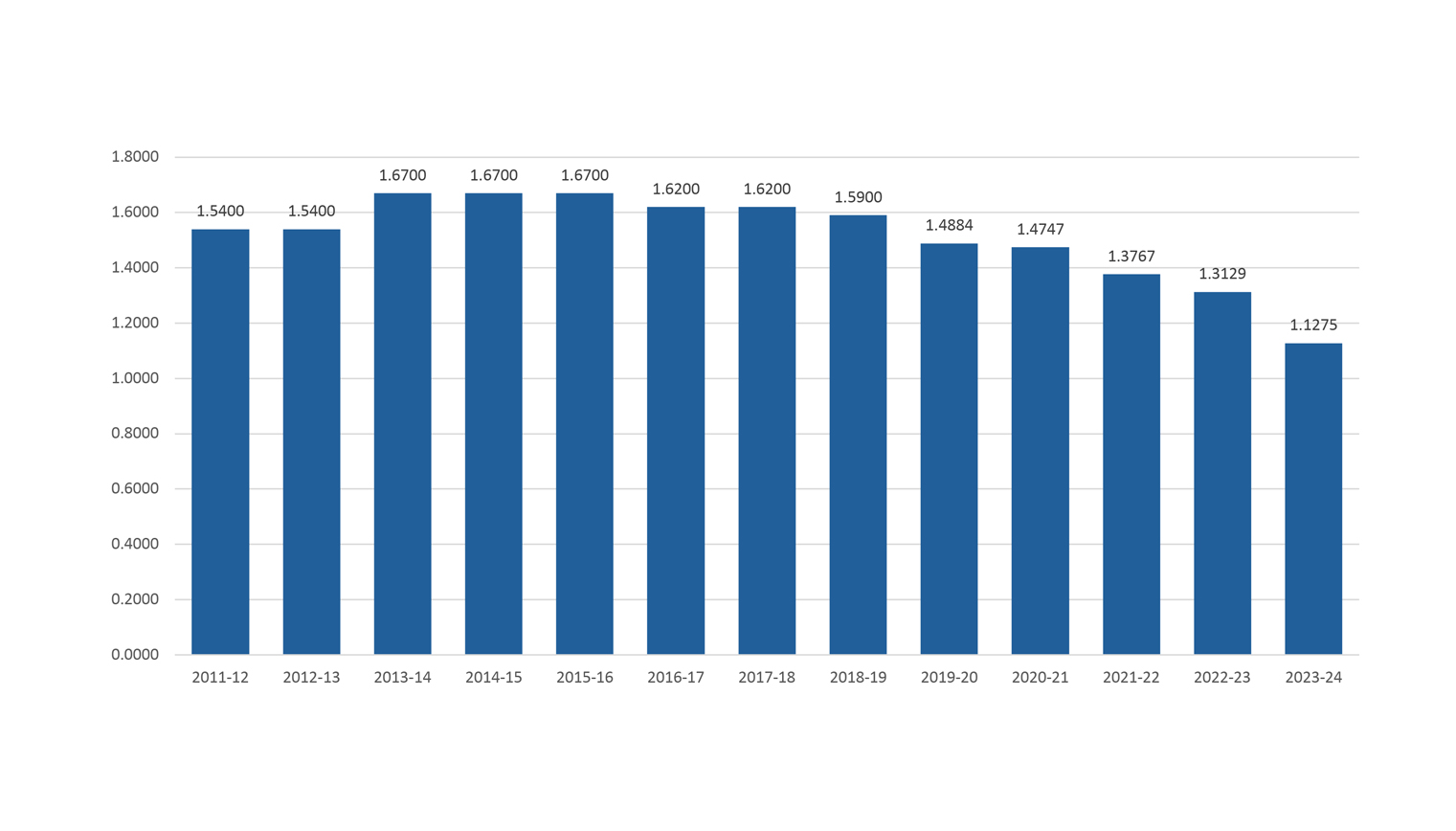

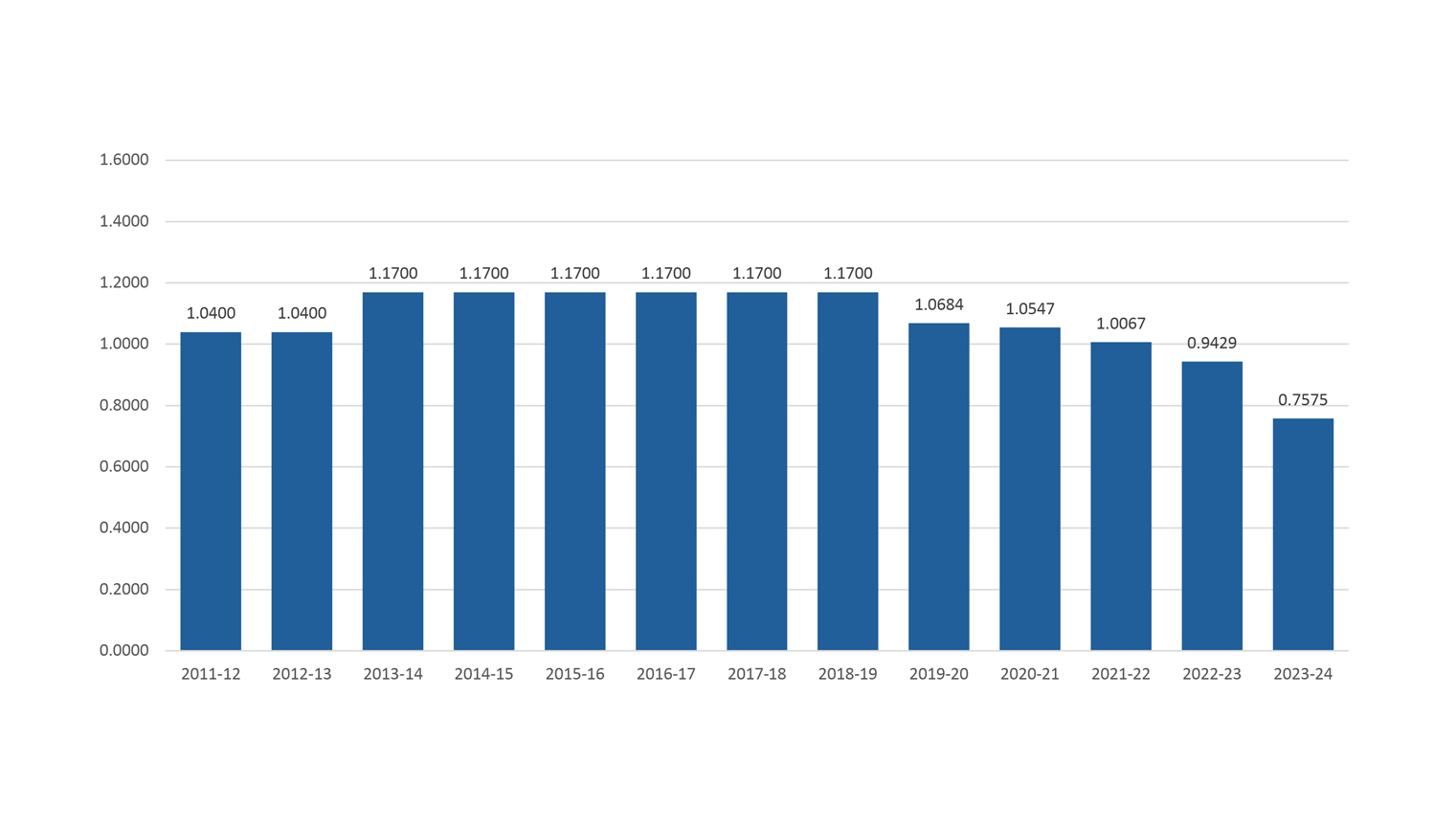

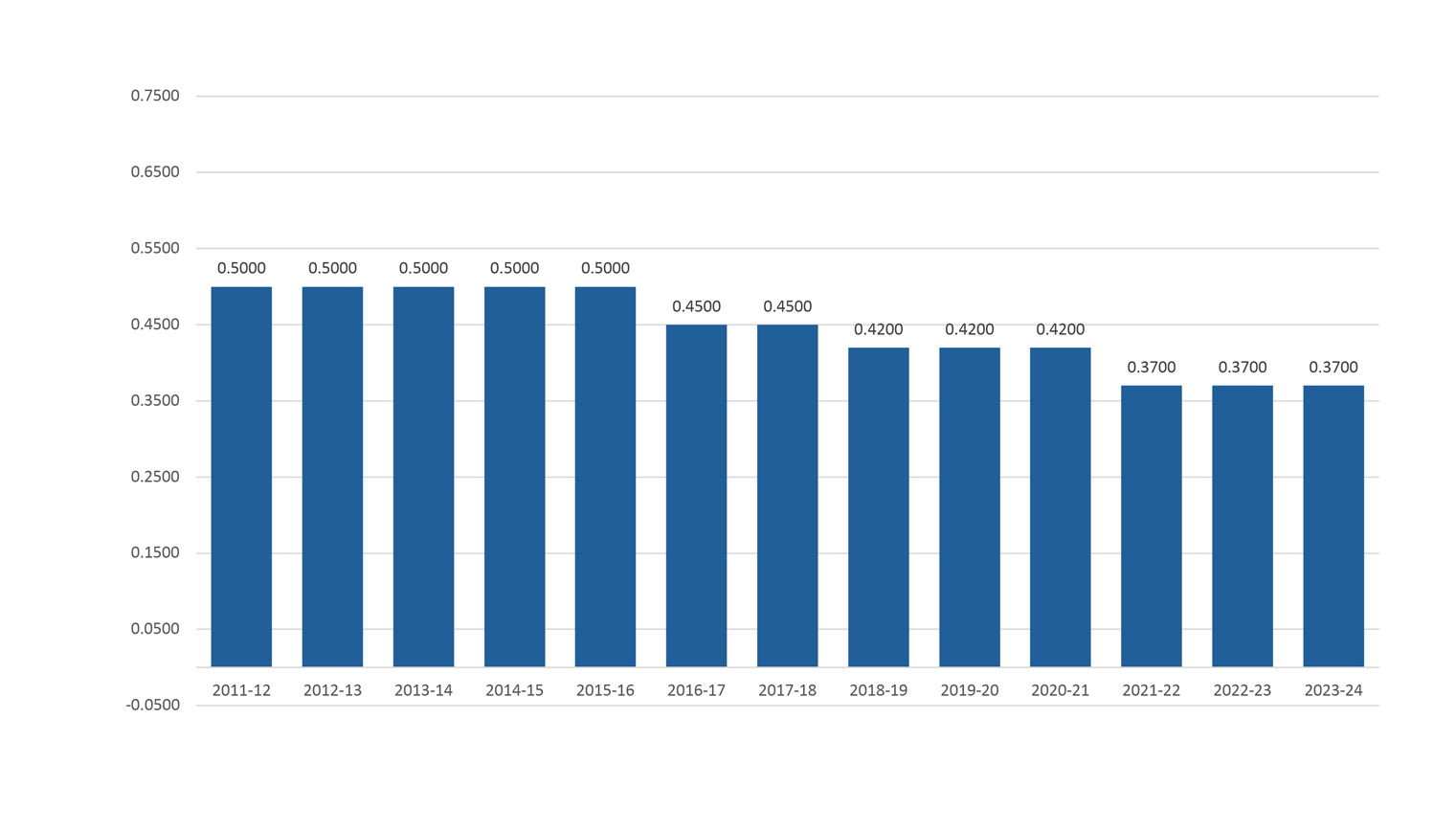

Historic Tax Rate Comparison

Total Property Tax per $100 Valuation

Maintenance & Operating (M&O) Property Tax per $100 Valuation

Interest & Sinking (I&S) Property Tax Per $100 Valuation

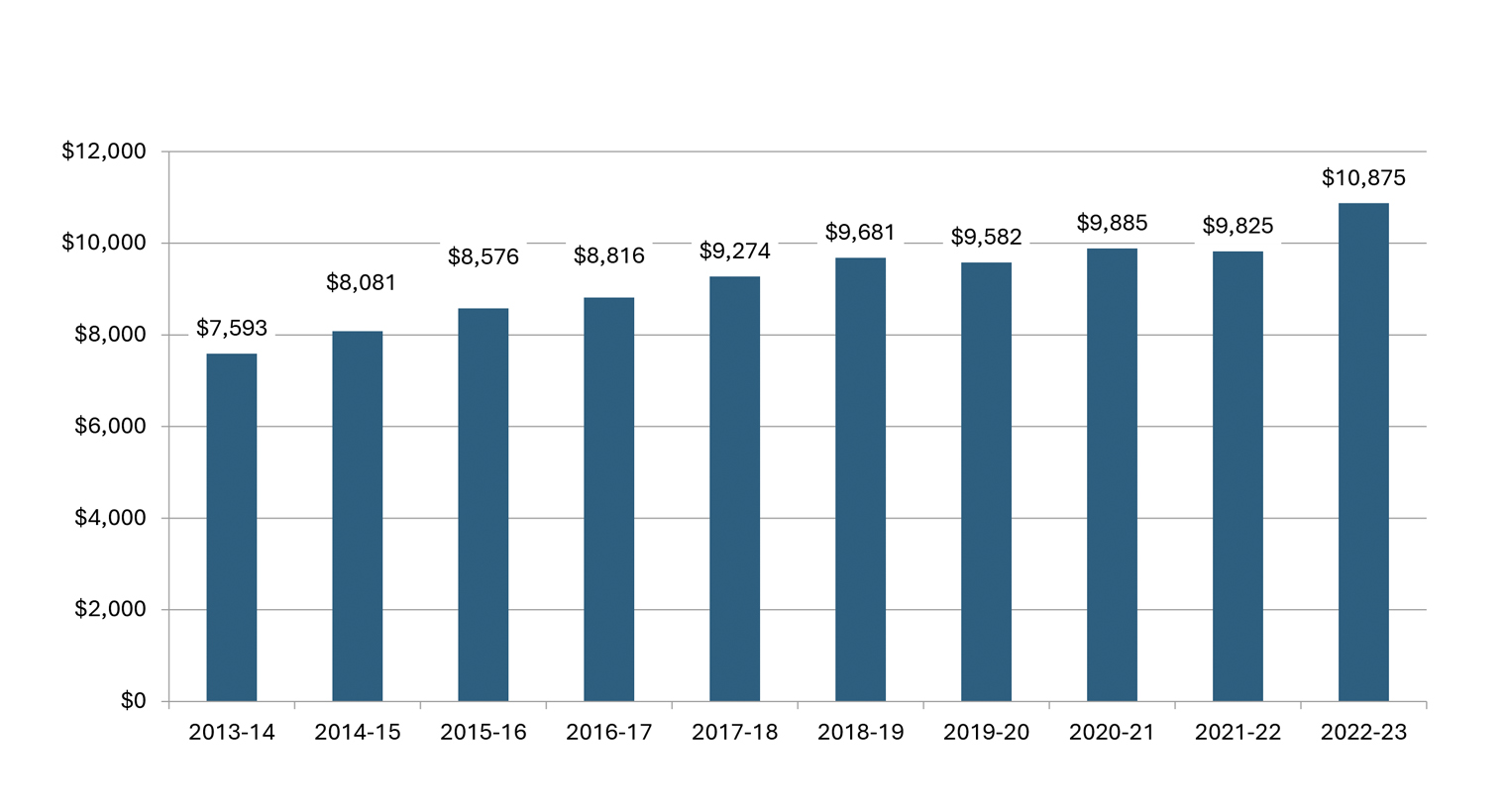

General Fund Revenues Per Student

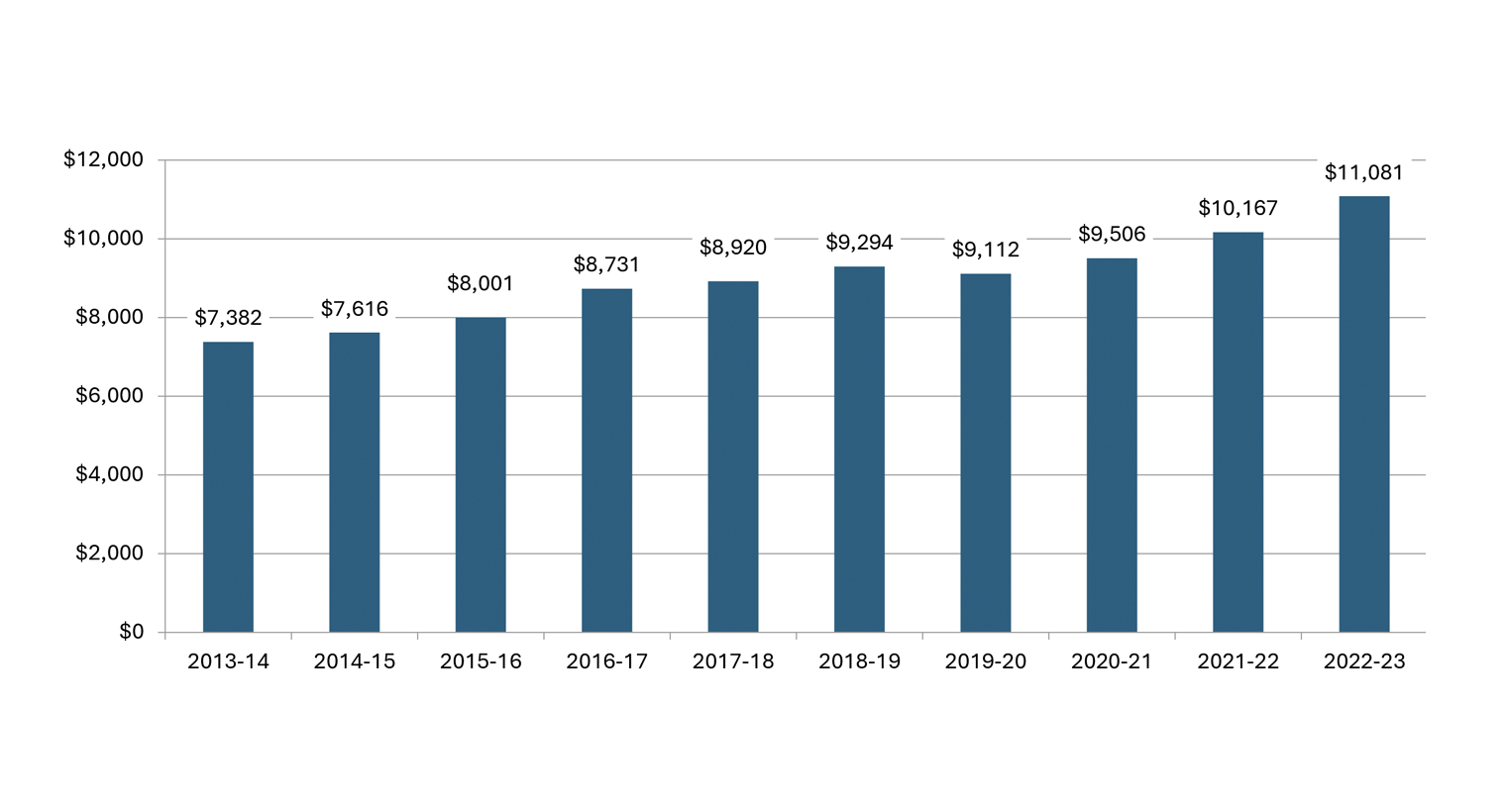

General Fund Expenditures Per Student

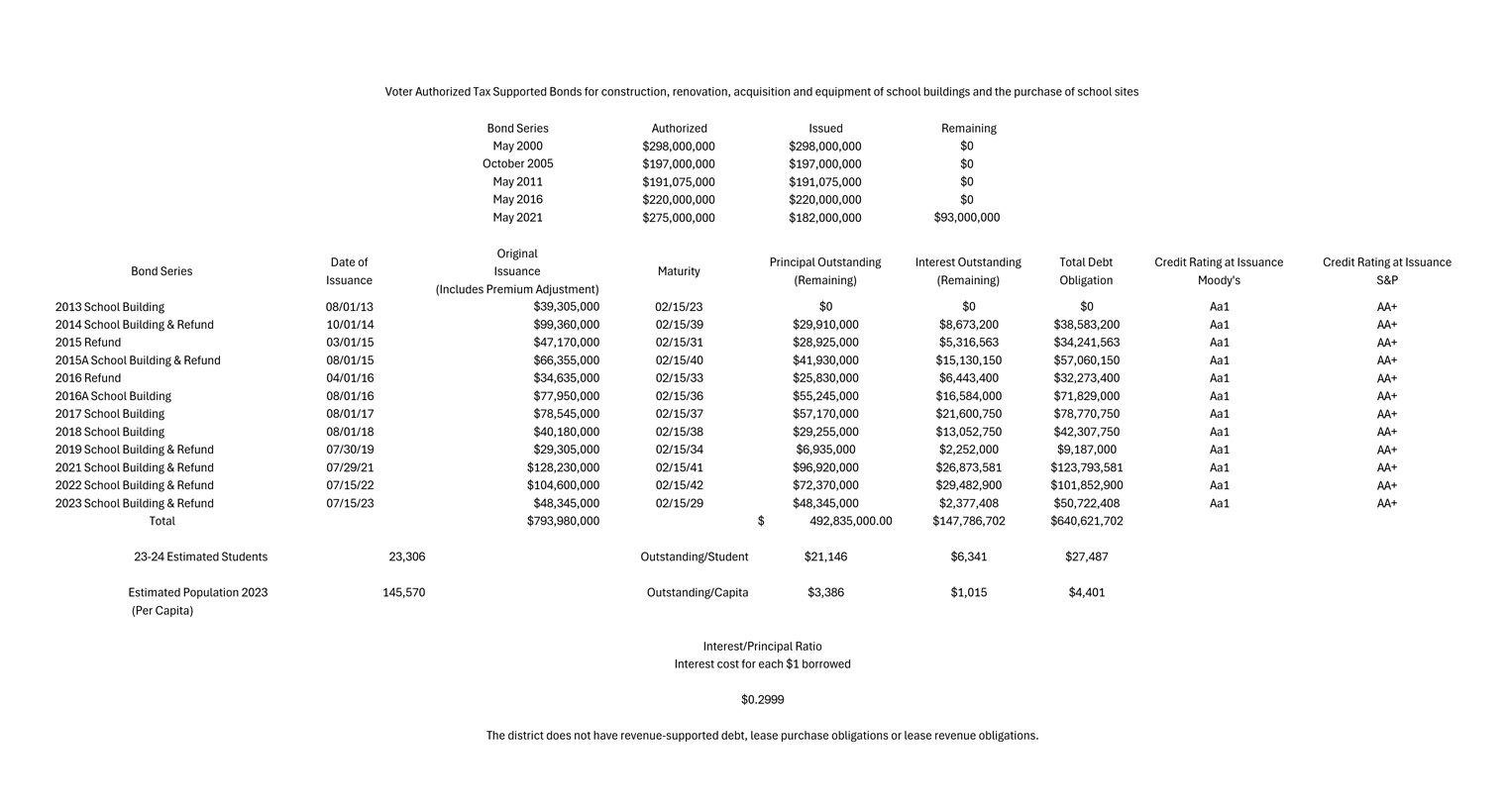

Debt Service Requirements as of 7/15/23

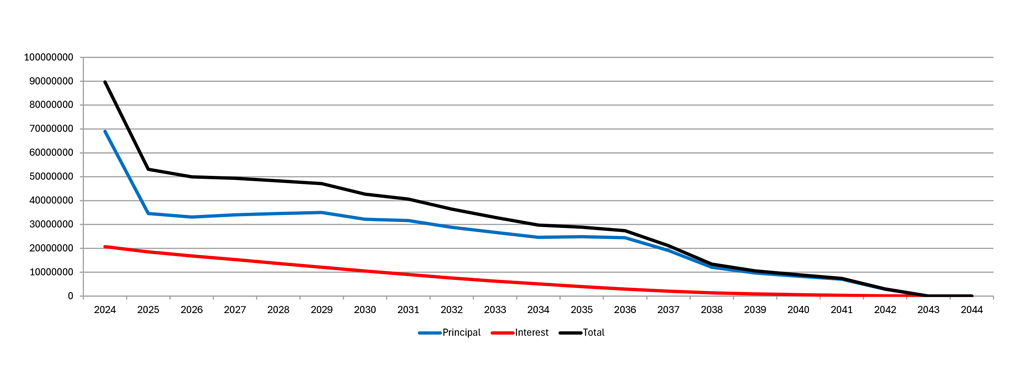

Debt Service Requirements

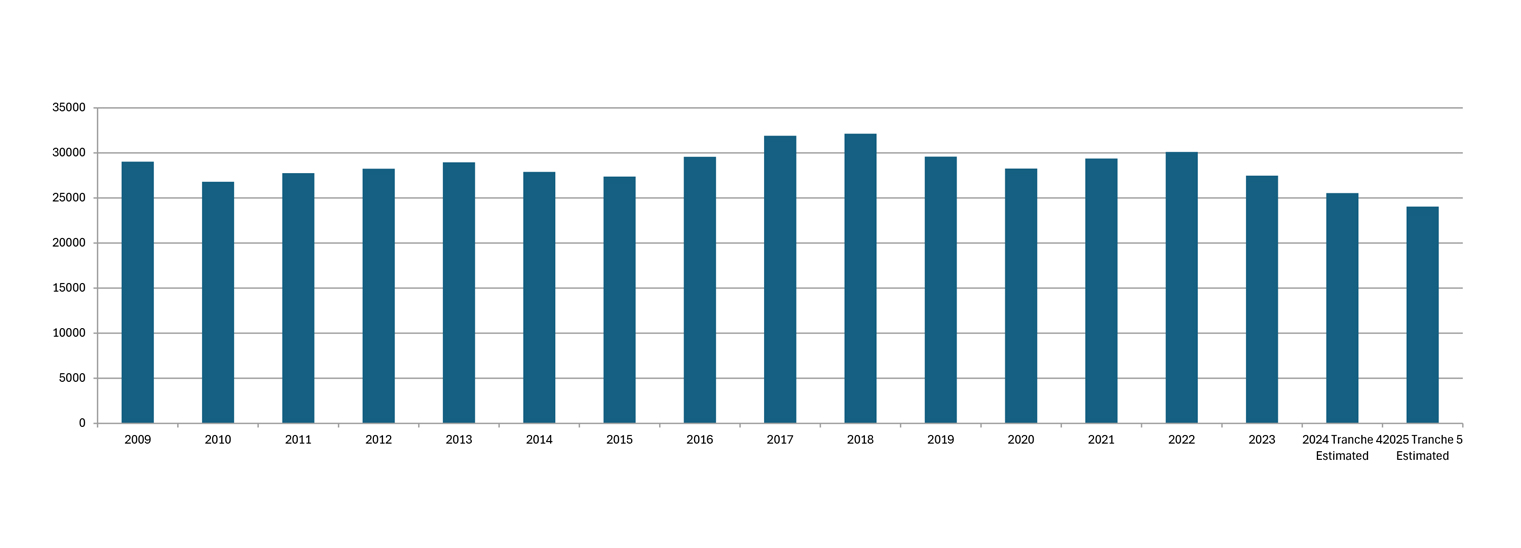

Tax Supported Debt Per Student

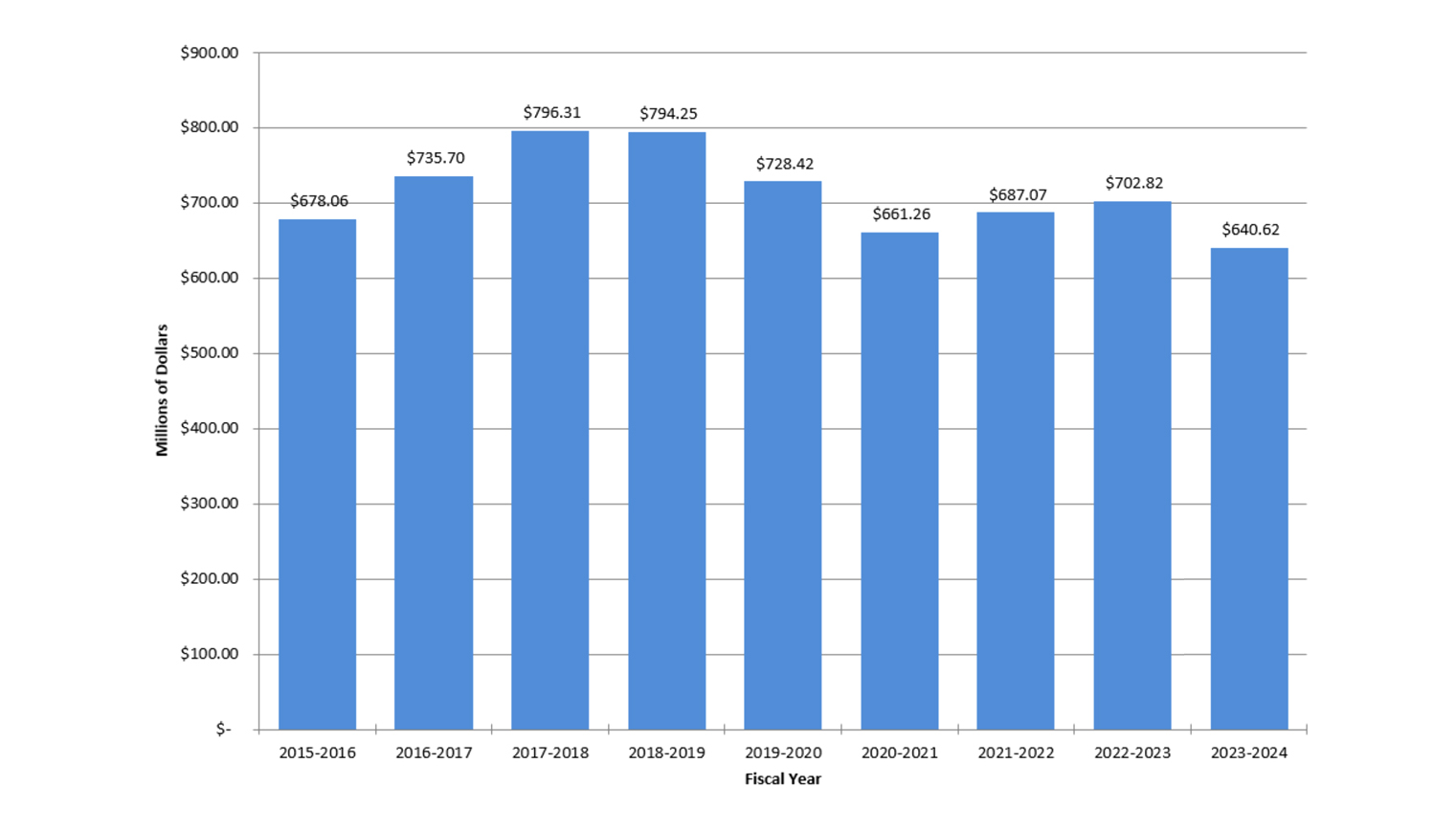

Tax Supported Debt (in Millions)

Debt Information

- McKinney ISD Debt Service Information

- S&P Global Ratings Letter

- Moody’s Rating Letter

- Debt at a Glance Tool

- Bond Review Board Local Government Debt Data

Indep. Registered Municipal Advisor Certificate

Audited Financial Statements

- 2022-2023 Audited Financial Statement

- 2021-2022 Audited Financial Statement

- 2020-2021 Audited Financial Statement

- 2019-2020 Audited Financial Statement

- 2018-2019 Audited Financial Statement

- 2017-2018 Audited Financial Statement

- 2016-2017 Audited Financial Statement

- 2015-2016 Audited Financial Statement

- 2014-2015 Audited Financial Statement

- 2013-2014 Audited Financial Statement

- 2012-2013 Audited Financial Statement

- 2011-2012 Audited Financial Statement

- 2010-2011 Audited Financial Statement

- 2009-2010 Audited Financial Statement

- 2008-2009 Audited Financial Statement

- 2007-2008 Audited Financial Statement

- 2006-2007 Audited Financial Statement

Financial Integrity Rating System of Texas (FIRST)

- 2022-2023 Financial Integrity Rating System of Texas (FIRST)

- 2021-2022 Financial Integrity Rating System of Texas (FIRST)

- 2020-2021 Financial Integrity Rating System of Texas (FIRST)

- 2019-2020 Financial Integrity Rating System of Texas (FIRST)

- 2018-2019 Financial Integrity Rating System of Texas (FIRST)

- 2017-2018 Financial Integrity Rating System of Texas (FIRST)

- 2016-2017 Financial Integrity Rating System of Texas (FIRST)

- 2014-2015 Financial Integrity Rating System of Texas (FIRST)

- 2011-2012 Financial Integrity Rating System of Texas (FIRST)

- 2010-2011 Financial Integrity Rating System of Texas (FIRST)

- 2009-2010 Financial Integrity Rating System of Texas (FIRST)

- 2008-2009 Financial Integrity Rating System of Texas (FIRST)

- 2007-2008 Financial Integrity Rating System of Texas (FIRST)

Budget/Taxes

- 2023-24 Adopted Budget

- 2023-24 Adopted Budget

- 2023-24 Proposed Budget

- 2023-24 Proposed Budget

- 2023-24 Budget Historical Comparison

- 2022-23 Budget Historical Comparison

- 2022-23 Adopted Budget

- 2022-23 Adopted Budget

- 2022-23 Proposed Budget

- 2022-23 Proposed Budget

- 2021-22 Adopted Budget

- 2021-22 Adopted Budget

- 2021-22 Budget Historical Comparison

- 2021-22 Budget Narrative

- 2021-22 Proposed Budget

- 2021-22 Proposed Budget

- 2020-21 Adopted Budget

- 2020-21 Adopted Budget

- 2020-21 Budget Narrative

- 2020-21 Budget Historical Comparison

- 2019-20 Adopted Budget

- 2019-20 Adopted Budget

- 2019-20 Budget Historical Comparison

- 2019-20 Budget Narrative

- 2019-20 Proposed Budget

- 2019-20 Proposed Budget

- 2018-19 Adopted Budget

- 2018-19 Adopted Budget

- 2018-19 Budget Narrative

- 2018-19 Budget Historical Comparison

- 2018-19 Proposed Budget

- 2018-19 Proposed Budget

- 2017-18 Adopted Budget

- 2017-18 Adopted Budget

- 2017-2018 Budget Narrative

- 2017-2018 Budget Historical Comparison

- 2017-2018 Proposed Budget

- 2017-2018 Proposed Budget

- 2016-2017 Adopted Budget

- 2016-2017 Budget Narrative

- 2016-2017 Budget Historical Comparison

- 2016-2017 Proposed Budget

- 2016-2017 Proposed Budget

- 2015-2016 Adopted Budget

- 2015-2016 Adopted Budget

- 2015-2016 Budget Narrative

- 2015-2016 Proposed Budget

- 2014-2015 Adopted Budget

- 2014-2015 Adopted Budget

- 2014-2015 Budget Narrative

- 2013-2014 Adopted Budget

- 2013-2014 Adopted Budget

- 2013-2014 Budget Narrative

- 2012-2013 Adopted Budget

- 2012-2013 Adopted Budget

- 2011-2012 Adopted Budget

- 2011-2012 Adopted Budget

- 2010-2011 Adopted Budget

- 2010-2011 Adopted Budget

- 2009-2010 Adopted Budget

- 2008-2009 Adopted Budget

- 2007-2008 Adopted Budget

Budget Books

Bond Reports

McKinney ISD has no scheduled upcoming bond elections at this time.

- 2021 Bond Program Report (April 2024)

- 2016 Bond Program Report (April 2024)

- 2021 Bond Program Report (March 2024)

- 2016 Bond Program Report (March 2024)

- 2021 Bond Program Report (February 2024)

- 2016 Bond Program Report (February 2024)

- 2021 Bond Program Report (January 2024)

- 2016 Bond Program Report (January 2024)

- 2021 Bond Program Report (December 2023)

- 2016 Bond Program Report (December 2023)

- 2021 Bond Program Report (November 2023)

- 2016 Bond Program Report (November 2023)

- 2021 Bond Program Report (October 2023)

- 2016 Bond Program Report (October 2023)

- 2021 Bond Program Report (September 2023)

- 2016 Bond Program Report (September 2023)

- 2021 Bond Program Report (August 2023)

- 2016 Bond Program Report (August 2023)

- 2021 Bond Program Report (July 2023)

- 2016 Bond Program Report (July 2023)

- 2021 Bond Program Report (June 2023)

- 2016 Bond Program Report (June 2023)

- 2021 Bond Program Report (May 2023)

- 2016 Bond Program Report (May 2023)

- 2021 Bond Program Report (April 2023)

- 2016 Bond Program Report (April 2023)

- 2021 Bond Program Report (March 2023)

- 2016 Bond Program Report (March 2023)

- 2021 Bond Program Report (February 2023)

- 2016 Bond Program Report (February 2023)

- 2021 Bond Program Report (January 2023)

- 2016 Bond Program Report (January 2023)

- 2021 Bond Program Report (December 2022)

- 2016 Bond Program Report (December 2022)

- 2021 Bond Program Report (November 2022)

- 2016 Bond Program Report (November 2022)

- 2021 Bond Program Report (October 2022)

- 2016 Bond Program Report (October 2022)

- 2021 Bond Program Report September (2022)

- 2016 Bond Program Report September (2022)

- 2021 Bond Program Report (August 2022)

- 2016 Bond Program Report (August 2022)

- 2021 Bond Program Report (July 2022)

- 2016 Bond Program Report (July 2022)

- 2021 Bond Program Report (May 2022)

- 2021 Bond Program Report (April 2022)

- 2021 Bond Program Report (March 2022)

- 2021 Bond Program Report (February 2022)

- 2021 Bond Program Report (January 2022)

- 2021 Bond Program Report (December 2021)

- 2021 Bond Program Report (November 2021)

- 2021 Bond Program Report (October 2021)

- 2021 Bond Program Report (September 2021)

- 2016 Bond Program Report (May 2022)

- 2016 Bond Program Report (April 2022)

- 2016 Bond Program Report (March 2022)

- 2016 Bond Program Report (February 2022)

- 2016 Bond Program Report (January 2022)

- 2016 Bond Program Report (December 2021)

- 2016 Bond Program Report (November 2021)

- 2016 Bond Program Report (October 2021)

- 2016 Bond Program Report (September 2021)

- 2016 Bond Program Report (August 2021)

- 2016 Bond Program Report (July 2021)

- 2016 Bond Program Report (May 2021)

- 2016 Bond Program Report (April 2021)

- 2016 Bond Program Report (March 2021)

- 2016 Bond Program Report (February 2021)

- 2016 Bond Program Report (January 2021)

- 2016 Bond Program Report (December 2020)

- 2016 Bond Program Report (November 2020)

- 2016 Bond Program Report (October 2020)

- 2016 Bond Program Report (September 2020)

- 2016 Bond Program Report (August 2020)

- 2016 Bond Program Report (July 2020)

- 2016 Bond Program Report (May 2020)

- 2016 Bond Program Report (April 2020)

- 2016 Bond Program Report (March 2020)

- 2016 Bond Program Report (February 2020)

- 2016 Bond Program Report (January 2020)

- 2016 Bond Program Report (December 2019)

- 2016 Bond Program Report (November 2019)

- 2016 Bond Program Report (October 2019)

- 2016 Bond Program Report (September 2019)

- 2016 Bond Program Report (August 2019)

- 2016 Bond Program Report (July 2019)

- 2016 Bond Program Report (June 2019)

- 2016 Bond Program Report (May 2019)

- 2016 Bond Program Report (April 2019)

- 2016 Bond Program Report (March 2019)

- 2016 Bond Program Report (February 2019)

- 2016 Bond Program Report (January 2019)

- 2016 Bond Program Report (December 2018)

- 2016 Bond Program Report (November 2018)

- 2016 Bond Program Report (October 2018)

- 2016 Bond Program Report (September 2018)

- 2016 Bond Program Report (August 2018)

- 2016 Bond Program Report (July 2018)

- 2016 Bond Program Report (June 2018)

- 2016 Bond Program Report (May 2018)

- 2016 Bond Program Report (April 2018)

- 2016 Bond Program Report (March 2018)

- 2016 Bond Program Report (February 2018)

- 2016 Bond Program Report (January 2018)

- 2016 Bond Program Report (December 2017)

- 2016 Bond Program Report (August 2017)

- 2016 Bond Program Report (September 2017)

- 2016 Bond Program Report (November 2017)

- 2011 Bond Program Report (August 2017)

- 2011 Bond Program Report (September 2017)

- 2011 Bond Program Report (November 2017)

- 2000 Bond Program Report (Final)

- Energy Board Report

Manuals

- MISD Grant Policies and Procedures Manual

- Student Activity Manual

- Accounting and Purchasing Manual

- Federal Grants Manual

Other

- BSG Organizational Chart

- Financial Fraud Hotline

- Internet Fundraising

- Annual Investment Report

- Quarterly Investment Report

- Board Members

- S. Pratt – Superintendent Contract

- S. Pratt – 2024 Contract Amendment

Information Requests

Email your request including your name, mailing address, phone number and a list of requested documents to [email protected].

Notice of Public Meeting

The McKinney Independent School District will hold a public meeting at 6:00 p.m. on Monday, June 24, 2024 in the Community Event Center at MISD Stadium, McKinney, Texas for comments regarding the school district’s proposed budget and tax rate for fiscal year 2024-25. Public participation is invited.

Office of Business & Finance

#1 Duvall Street

McKinney, Texas 75069

469-302-4131